With so much information already available in your eCommerce platform, do you really need to calculate the RFM score for each customer? RFM scoring and segmentation might seem complicated and unnecessary, but it’s quite the opposite. The clarity RFM brings over your customer distribution makes it one of the most effective segmentation methods.

You’re already collecting tons of data about your customers. What RFM segmentation does is transform this valuable resource into an asset for growth.

RFM analysis goes beyond giving customers a score based on customer purchase behavior. It helps you:

- Identify all types of customers your business has;

- Build a foundation for future qualitative research to learn more about the motivations and needs behind their behavior;

- Design meaningful customer experiences;

- Create targeted RFM marketing campaigns based on customer behavior;

- Optimize your acquisition and retention strategies based on what you know about your most valuable customer segments.

It all starts with calculating the RFM score for each customer.

What is the RFM score?

The RFM score represents the value you give to each variable used in an RFM analysis: recency, frequency, and monetary value. The RFM score is a numerical score that helps you recognize all types of customers, from the best to the worst.

The RFM model helps you generate segments based on customer behavior analysis that you can apply to your entire customer base.

You have to assign a score for each variable:

- “R” stands for Recency and refers to how recently a customer has bought;

- “F” stands for Frequency and refers to how frequently a customer has ordered;

- “M” stands for Monetary and refers to how much a customer has spent buying from your business.

After you calculate the RFM score for each customer, you’ll be able to group your customers into different segments that reflect their purchase behavior. You’ll easily spot loyal customers from deal hunters and everything in between.

What are the Three Components of the RFM Formula?

To fully understand what an RFM score is, let’s examine what each of the three key variables means:

Recency (R)

Recency measures how recently a customer made a purchase. It indicates how engaged and active a customer is with your brand. The more recent the purchase, the higher the recency score.

Recency matters because it serves as an engagement indicator, showing that customers who purchased recently are more likely to engage with your marketing campaigns. It also acts as a retention predictor, as recent buyers are more likely to return. Additionally, high recency scores allow you to target customers with personalized messages and offers, maximizing the chances of repeat purchases.

Frequency (F)

Frequency measures how often a customer makes a purchase within a specified time period. It helps identify your loyal repeat buyers.

Frequency is crucial because it measures loyalty, indicating that high frequency correlates with customer satisfaction and loyalty to your products or services. Frequent buyers provide consistent revenue streams, making them valuable to your business. Moreover, customers with high frequency are more likely to respond positively to upsell and cross-sell opportunities, further boosting your revenue.

Monetary Value (M)

Monetary Value measures the total amount of money a customer has spent within a specified time period. It helps identify high-value customers who contribute significantly to your revenue.

Monetary value is important because it highlights revenue contribution, showing that customers with high monetary value make significant purchases. These customers are ideal targets for premium offers, loyalty programs, and exclusive promotions.

How to Calculate RFM Score?

Step 1: Analyze Historical Purchase Data

First, you have to analyze the historical purchase data, looking for the minimum and the maximum value for each of the three RFM variables or RFM metrics. This data should include details on purchase dates, the number of purchases, and the monetary value of each purchase for every customer.

Step 2: Choose the Suitable Scale

Second, you have to choose the suitable scale according to the size of your customer base:

- 1 – 3 scale for less than 30k customers;

- 1 – 4 scale for 30k – 200k customers;

- 1 – 5 scale for more than 200k customers.

The minimum and maximum values for recency, frequency, and monetary will help you define the intervals for each point in your scale.

Step 3: Define Intervals for Each Point

Then, you have to define the intervals for each point on your chosen scale using the minimum and maximum values for recency, frequency, and monetary value.

In the table below, you see a 1 to 5 scale used by a company with over 200k customers.

Metric | 1 (Lowest) | 2 | 3 | 4 | 5 (Highest) |

Recency | >12 months | 9-12 months | 6-9 months | 3-6 months | <3 months |

Frequency | 1 purchase | 2-3 purchases | 4 purchases | 5 purchases | >5 purchases |

Monetary | <$10 | $10-$20 | $20-$35 | $35-$45 | >$45 |

In this company’s case, a customer that purchased more than a year ago receives the minimum score for recency, respectively 1 point. If that customer’s purchase frequency is higher than 5, they receive the maximum score – 5 points. If the monetary value is $45, the customer gets 5 points.

Step 4: Assign Scores

Assign scores to each customer based on their recency, frequency, and monetary values according to the defined intervals. In our example, the RFM score for the customer will be 155: 1 for recency, 5 for frequency, and 5 for monetary value.

Step 5: Segment Customers

Once you have assigned RFM scores to all customers, you can segment them into different groups based on their scores. Each segment will represent customers with similar purchasing behaviors. What does the 155 RFM score say about the customer in our example? What segment do they fall into? According to Omniconvert’s RFM segmentation, this customer is an Ex-Lover – a customer who used to be loyal to your brand but stopped buying from you a long time ago.

Let’s see the RFM scores and main characteristics for each customer segment:

Like what you’re reading?

Join the informed eCommerce crowd!

We will never bug you with irrelevant info.

By clicking the Button, you confirm that you agree with our Terms and Conditions.

RFM score segments

You could calculate RFM scores and perform RFM segmentation manually, but that would be tiring, and you would have to go through the same process month after month. Unfortunately, the manual calculation doesn’t help you react in real-time in multiple situations, like when you get a batch of new high potential customers.

The RFM score signals that you should include them in the onboarding process right away and send the correct email for these new high-value customers that might become your next loyal customers.

Ideally, you should calculate the RFM score automatically, using a dedicated solution for RFM segmentation. This way, you’ll have the RFM constantly updated based on customers’ behavior.

For example, in REVEAL, a customer value optimization platform developed by Omniconvert, all customer RFM scores are calculated automatically based on transactional data captured by your eCommerce platform.

With REVEAL, you have access to 11 default RFM segments that you can name and regroup as you wish to make them 100% relevant to your business model.

The default RFM segments name are inspired by love life, so you can easily differentiate between a “Soulmate,” a “New Passion,” and a “Don Juan.”

Let’s look at the RFM scores and the main characteristics for each of these 11 segments.

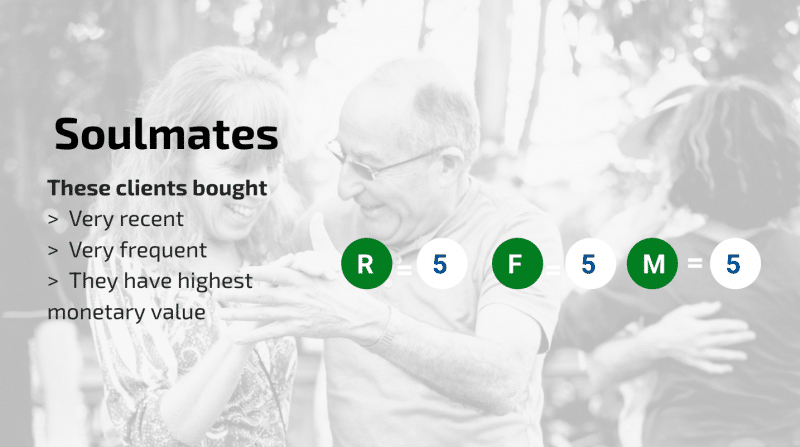

Soulmates

RFM Score

Recency = 5

Frequency = 5

Monetary value = 5

One of the main reasons you want to calculate the RFM score is to identify your best customers. It’s crystal clear that Soulmates are your ideal customers with a perfect RFM score of 555. These customers have recently made a purchase, buy frequently, and spend the most money. You want to keep the maximum score for all variables as long as possible. Also, you want to learn all about what makes Soulmates loyal, use the insights to inform your future campaigns, and improve customer lifetime value.

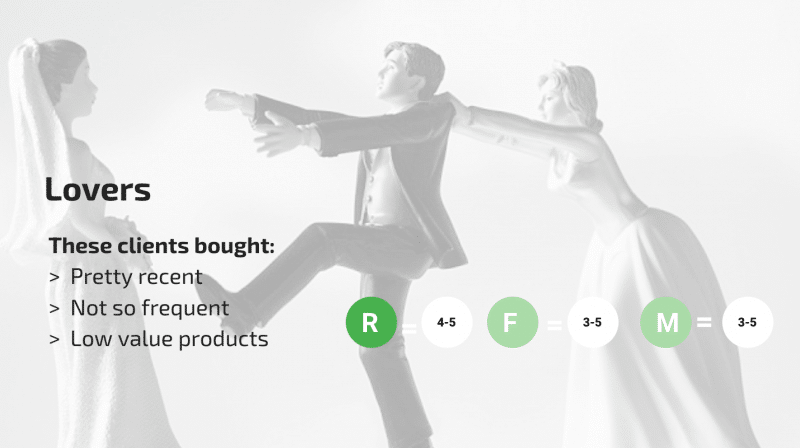

Lovers

RFM Score

Recency = 4 – 5

Frequency = 3 – 5

Monetary value = 3 – 5

Lovers are almost as good as your Soulmates, but they aren’t so excited about you yet. These customers have made recent purchases, buy frequently, and spend a considerable amount, but there is still room for growth in their engagement and loyalty. This RFM customer segment needs more nurturing, and your job is to eliminate frictions that prevent them from becoming your Soulmates.

New Passions

RFM Score

Recency = 5

Frequency = 1

Monetary value = 4 – 5

New Passions are new customers with the highest monetary value among all new customers. They have made a recent purchase, but it is their first interaction with your business. If you treat them right, they might become your next Lovers and Soulmates. The key is to nail the onboarding and encourage further purchases

Flirting

RFM Score

Recency = 4

Frequency = 1

Monetary value = 4

Flirting customers are new customers who placed their first order a while ago, and the monetary value wasn’t as high as a New Passion customer. They have potential, so you have to encourage several purchases before rushing to conclusions. Encourage additional purchases through targeted marketing campaigns, personalized offers, and follow-up communications.

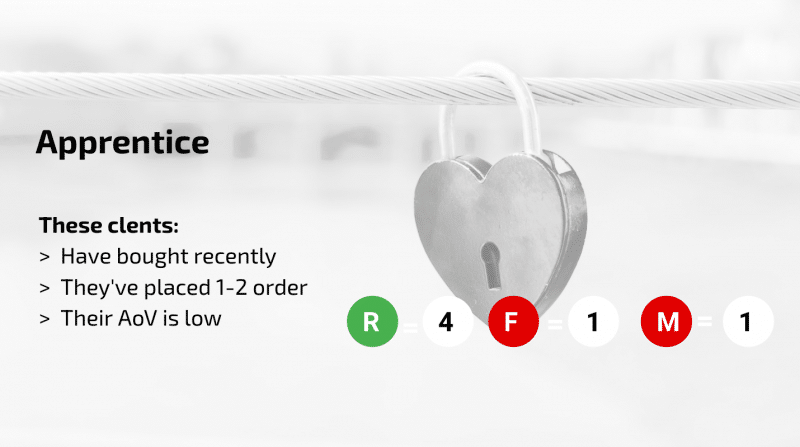

Apprentice

RFM Score

Recency = 4

Frequency = 1

Monetary value = 1

With one or two low-value orders, the Apprentice segment includes new customers that aren’t willing to spend more until you win their trust. You need to find their motivations and what would get them more engaged. Offer personalized experiences, address any concerns they might have, and provide incentives for repeat purchases.

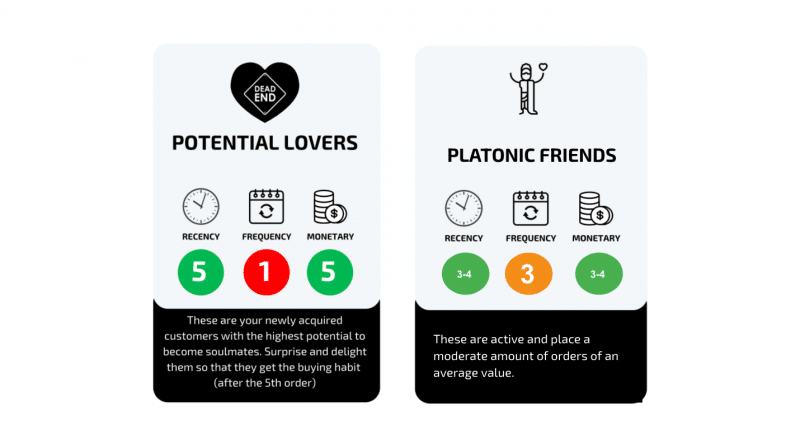

Platonic Friends

RFM Score

Recency = 3 – 4

Frequency = 3

Monetary value = 3 – 4

Platonic Friends are customers that buy from your store quite regularly, and the orders they place are below average. Still, they aren’t consistent yet, so you need to do extra work to increase the scores for each RFM variable.

Potential Lovers

RFM Score

Recency = 5

Frequency = 1

Monetary value = 5

The Potential Lovers segment of active customers is worthy of your attention since they’ve placed a couple of high-value orders, but have not yet made frequent purchases. With proper treatment, they might become your next Lovers.

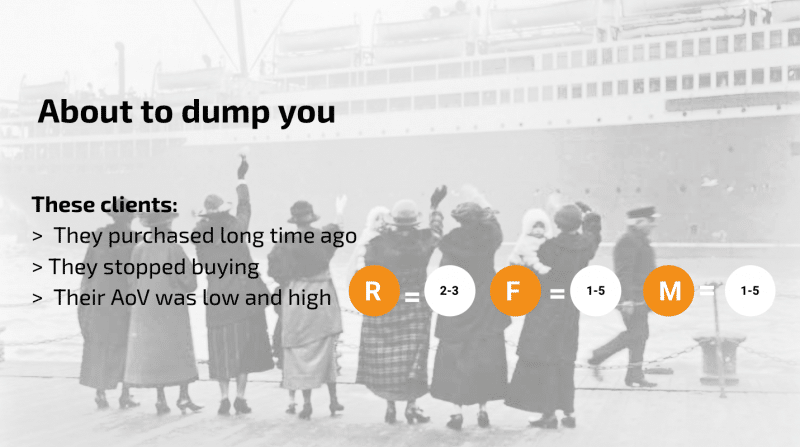

About To Dump You

RFM Score

Recency = 2 – 3

Frequency = 1 – 5

Monetary value = 1 – 5

The About To Dump You segment is represented by all types of customers who used to buy from you but haven’t in a while. You can try to reactivate the ones who used to have high frequency and monetary value. You can implement re-engagement strategies such as personalized emails, special discounts, and loyalty incentives to win them back. Ideally, your best customers should never get in this segment.

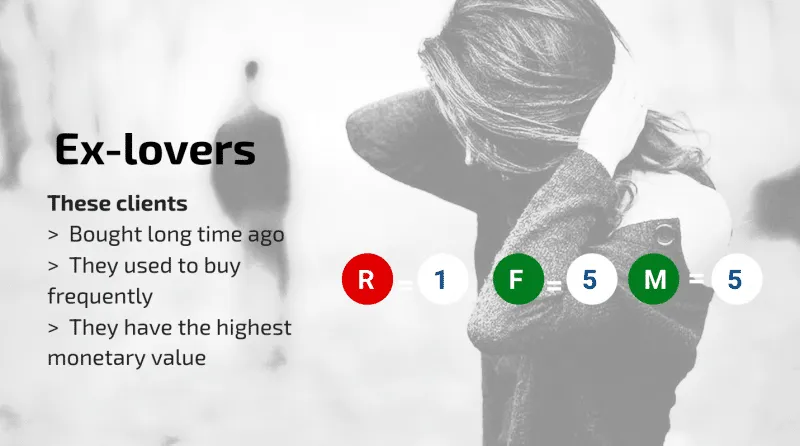

Ex-Lovers

RFM Score

Recency = 1

Frequency = 5

Monetary value = 5

Ex-Lovers are inactive customers who left your store a while ago and have high frequency and monetary value. However, they have not made a purchase for a long time, indicating that you have lost them. While it might be challenging to win back Ex-Lovers, understanding why they left can provide valuable insights to prevent other customers from following the same path. Conduct surveys or gather feedback to identify potential issues and improve your offerings and customer experience.

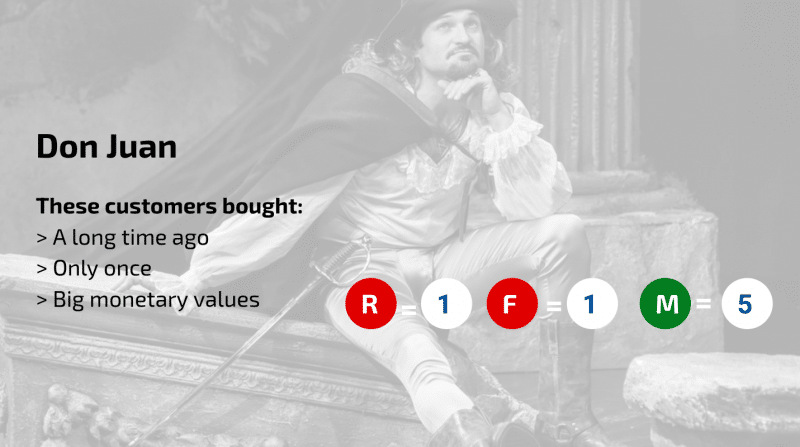

Don Juan

RFM Score

Recency = 1

Frequency = 1

Monetary value = 5

Just like one-night stands, Don Juan customers place one high-value order and never come back. They represent a missed opportunity for long-term engagement and loyalty. You need to find out why they never came back and dig deeper for clues. Maybe it was a toxic product or a poor customer experience. Dig deeper for clues by analyzing their purchase journey, seeking feedback, and reviewing their interactions with your brand.

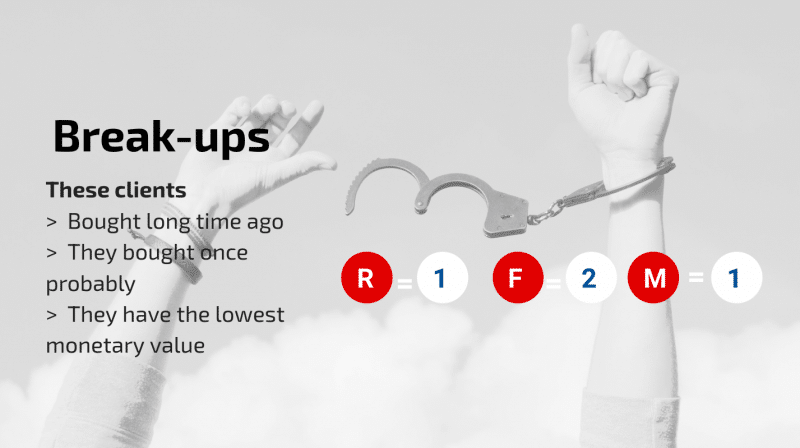

Break-Ups

RFM Score

Recency = 1

Frequency = 2

Monetary value = 1

The Break-Ups segment includes low valued customers that purchased sporadically and placed low-value orders. Don’t waste your time with them as they’re part of the natural churn rate – 15-25% of customers end up in this segment.

Wrap up

RFM modeling and RFM score emphasize that not all customers are created equal, so you should focus on retaining the most valuable customers and acquiring more customers like your best customers.

Plus, automated RFM segmentation keeps RFM scores updated and helps you know how your customers’ behavior changes over time based on their purchase history. It also makes it easier for you to identify how customer segments’ evolution influences various KPIs, like the customer lifetime value, repeat purchase rate, or customer retention rate.

The more you learn about each RFM segment, the better you become at optimizing strategies, from acquisition to retention. In our CVO Academy courses, you’ll find all you need to know about the RFM score system, segmentation, and how to approach each segment.

We encourage you to invest time in understanding advanced eCommerce strategies so you can generate sustainable growth for your business.

Frequently asked questions

What is a good RFM score?

The best RFM score is the one with the highest values for each variable. If a store uses a 1 to 5 scale for recency, frequency, and monetary, with 5 being the highest, then the perfect RFM score is 555.

How do you interpret RFM results?

After you have the RFM scores for each customer, you can group customers to reflect different buying behaviors, differentiating your most loyal customers from your ex-customers. Looking at the overall image pictured by the RFM scores, you’ll be able to prioritize actions, like improving the loyalty program to avoid losing the most valuable customers or the onboarding process to retain more of your newly acquired customers.

What is the highest RFM score possible?

The highest RFM score possible depends on the scale you are using for each of the three components: Recency, Frequency, and Monetary value. If you are using a scale of 1 to 5 for each component, the highest possible RFM score is 555. This indicates that the customer has the highest score for recency (most recent purchase), frequency (most frequent purchases), and monetary value (highest spending).