-

Consumer Behavior in Marketing. Patterns, Types & Segmentation

-

How to Calculate Cost of Goods Sold: Definition, Examples & COGS Formula

-

Qualitative Research Methods: Examples, Limitations & Analysis

-

Thriving E-Commerce Industries Poised for Remarkable Growth

-

12 Best Companies for Customer Experience

-

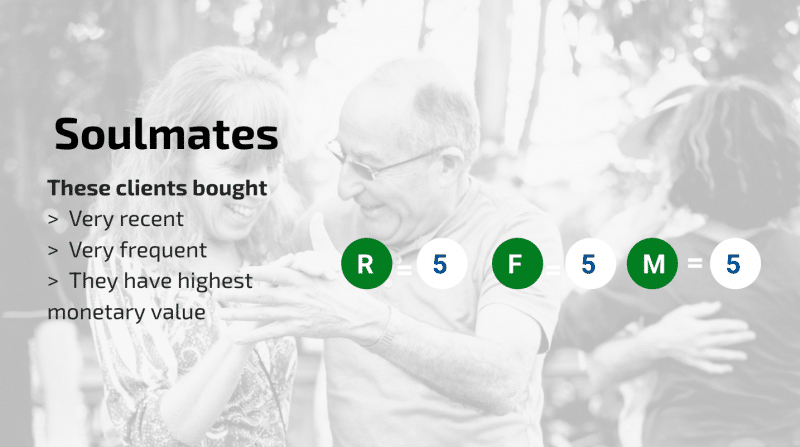

What is RFM Score: How to Calculate, RFM Formula, Examples

-

UVP (Unique Value Proposition)

-

Sample Size

Home The Omniconvert eCommerce Blog

Explore the latest trends in CRO, A/B testing, and Website Personalization

Welcome to the Omniconvert Blog: your ultimate resource for conversion rate optimization, A/B testing, and website personalization. We’re dedicated to helping you transform every visitor interaction into measurable results through smart, data-driven experiments and tailored user experiences.

Our expert articles, real-world case studies, and actionable guides are crafted to equip marketers, business leaders, and entrepreneurs with the insights and techniques needed to boost conversion rates and drive business growth. Whether you’re fine-tuning A/B tests, refining your website’s user journey, or personalizing content to resonate with your audience, join us to explore the cutting edge of digital optimization.

Our most popular articles

Explore our Most Popular Articles, a curated collection of our top-performing posts that deliver actionable insights. Each article is designed to empower you with the strategies and data-driven tactics needed to transform your digital performance.

Sign Up for Our CRO Newsletter

Sign up for our Weekly Newsletter to receive the latest insights on conversion rate optimization, A/B testing, and website personalization directly in your inbox. Stay ahead of the curve with curated tips, expert strategies, and actionable tactics to boost your digital performance every week.

Omniconvert Knowledge Base Topics

Dive into the Omniconvert Knowledgebase Topics, where our expertly curated articles on Conversion Rate Optimization, A/B Testing, Landing Page Optimization, and Website Personalization empower you with data-driven insights and actionable strategies to elevate your digital performance.

Omniconvert Knowledge Base Topics

Welcome to the Omniconvert Blog: your ultimate resource for conversion rate optimization, A/B testing, and website personalization. We’re dedicated to helping you transform every visitor interaction into measurable results through smart, data-driven experiments and tailored user experiences.

Our expert articles, real-world case studies, and actionable guides are crafted to equip marketers, business leaders, and entrepreneurs with the insights and techniques needed to boost conversion rates and drive business growth. Whether you’re fine-tuning A/B tests, refining your website’s user journey, or personalizing content to resonate with your audience, join us to explore the cutting edge of digital optimization.

-

Ecommerce Customer Retention Trends for 2026: What’s the Cost of Playing the Wrong Game?

Trends -

Omniconvert Explore 3.0: How New Testing Features Unlock Growth for Ecommerce

-

Top 50 Data Analysis Tools

Article -

23 Best Analytics Tools of 2026

Article -

Engagement Metrics: How to Measure and Different Uses

-

10 Best Call To Action Examples: Definition, Marketing, and Writing

Website Personalization -

22 Best Tools for CRO Audits

CRO -

Top 20 Ecommerce and Shopify CRO Experts

The Latest CRO Trends We Write About

Stay ahead of the curve with our latest insights on conversion rate optimization. Discover cutting-edge trends—from innovative A/B testing techniques to dynamic website personalization—that empower you with actionable tactics to drive digital growth.

Explore Omniconvert's Software Solutions

Explore Omniconvert and unlock the full potential of your digital strategy with our powerful trio of solutions—Omniconvert Explore, Reveal, and Pulse. Together, these tools deliver comprehensive insights, real-time analytics, and actionable strategies to help you drive conversions and elevate your user experience.

Your customers have the key to unlock your company's growth. Give them the voice they deserve.

See pricingMeasure what matters. Understand your customers better. Segment & address your customers.

See pricingCRO and UX FAQ's

Got questions about optimizing conversions and enhancing user experiences? Dive into our CRO and UX FAQ's for expert answers, actionable tips, and best practices that empower you to overcome challenges and drive digital success.

Conversion Rate Optimization (CRO) is all about making data-driven improvements to your website to encourage visitors to take desired actions. The core concepts include understanding user behavior, setting clear goals, testing variations (like A/B testing), analyzing the results, and continuously iterating to enhance user experience and boost conversions.

Begin by identifying areas on your site where visitors drop off or fail to convert. Set clear, measurable goals, then use tools such as heatmaps and analytics to gather data on user behavior. Form hypotheses for improvement, run controlled tests (such as A/B tests), and implement the changes that yield positive results while continuously monitoring performance

You can explore a range of accessible resources to kickstart your CRO journey: check out our CVO Academy course for step-by-step guidance, download our ebooks for detailed strategies, and subscribe to our YouTube channel for practical tips and real-life examples.

The main types of A/B testing include split URL testing—where two different versions of a webpage are compared, multivariate testing—which evaluates multiple elements simultaneously to determine the best combination, and multi-armed bandit testing—which dynamically adjusts traffic to favor better-performing variations in real time.

Website personalization involves tailoring the content and user experience based on individual visitor data, such as their behavior, demographics, or location. By delivering customized content or targeted offers, personalization aims to create a more engaging experience that increases the likelihood of conversion.